Vladimir E. Chabanov, Grand PhD., Professor

Contemporary economy features a number of disadvantages that prevent it from getting a state corresponding to present-day development of science, technology and human intelligence. The major disadvantage consists in the conflict between growing public nature of production and individual form of appropriation of production outcome (K. Marx “Capital”. Part 1). That is, the present state of economy is focused on personal income generation rather than on yielding benefit or providing people with means of subsistence. From here it follows that all its tools aim at drawing money not at raising public labor production efficiency.

Another archaic survival of economy consists in ignoring difference between an ordinary private estate, hacienda and state, as well as in striving for ruling them in the same manner. Indeed, like in a hacienda, in a state system, there are managing owners making up a bureaucracy class granted with all rights and privileges. Labor force deprived of rights designed to do everything is employed. There is an integrated hierarchy of structures seeking for making the highest profit, i.e. margin. Including but not limited to other expenses, the said structures include maintenance of the population. However, on a nationwide scale it becomes absurd since the state has no profit as such. All incomes the state receives shall be spent in some manner or other, and there is no alternative. On the other hand, the main purpose of the state consists in providing all people living in its territory with means of subsistence. Otherwise, why the state?! Hence, it is against nature to save on the population. It is understandable that such a shift of notions cannot but do tremendous harm to public.

This manifests itself through a variety of forms. Thus, the activity of economic entities is governed by earning money rather than by achieving actual results. This leads to the growth of money supply, not amount of the products produced. Disproportions in organization and number of structures that services business instead of the population grow. Number of excessive people the economy does not need at all grows. Commoditization of all kinds of labor has resulted in degradation of quality of both goods and services. Therefore, food become less useful, healthcare and pharmacology do not cure people but make them permanent patients. Administration does not serve the society but exercises its powers for its own benefits. Greed and cynicism rule the world. As a result, human culture and development, health and morality are suppressed. Nonequivalent exchange of products of labor has given rise to such a level of exploitation that brings humankind to the verge of starvation making any progress impossible.

Within such an economic system, everything is governed by money. However, money as such is far from being flawless. It possesses global disadvantages that prevent it from being truly efficient tools for both production and distribution. That is why all global and local economic crises have exceptionally financial nature. In this regard, let us study out in details what the central failures of present money are.

The first and the most essential defect of contemporary money is in that it has no real content. Indeed, after the gold parity was eliminated in the 1970s, the par value of money has been set by speculative stock trading, comparison with other currencies, political, information, or, even military pressure exerted by advanced countries rather than by its actual purchasing power. As a result, money lost its content, and all that could be salvaged from its former essence was its form. That is why now, nobody knows what a ruble, dollar, euro, or pound sterling genuinely is. The abstractions with indefinite content but of tremendous value. In this regard, money that is the major measurement for all economic processes, has become a plaything of interests, egoisms, passions, an object of bargaining, a tool of pressure and exploitation. Actually, it has turned into funny money which valuable content is determined by an illusion of value, or artificial attachment to it of illusory ability to replace real values. Hence, economy has become an everyday pursuit for funny money, which makes it really absurd. There is no question of believe that the said circumstance is conducive to increased fairness of estimate of results of labor, fair distribution of its outcomes and making unambiguous economic performances.

Consequently, national currency of the major part of countries turned out to be helpless against global expansion of world capital. Tremendous financial rent has appeared that poor countries pay to the rich ones. This led to imbalance of international market relations, gave rise to incredible exploitation of weak economic systems by powerful ones, improved the standard of living of the population of developed countries, and placed the other states onto the verge of survival. Indeed, over 70% of all world resources are consumed by the countries of the Golden Billion, while the rest 6 billion of the World’s people have to content with less than 30% of resources. That led to outbreak of crime and terrorism, drug addiction and moral degeneration of all countries of the world. Money that is not assigned to servicing people yet indispensable for their survival have tightened grip over all aspects of human existence. It has turned into master from servant to be growingly used for unearned income generation. This should come as no surprise, since money behavior is dictated by its earning power rather than public benefit it can bring.

Yet another global disadvantage of contemporary money is permanent monetary depreciation, fast or low inflation typical of any world currency, which makes confusing all indices calculated on the monetary basis. Therefore, the society bears huge and irreparable losses. Actually, what would happen to physics and technics, if standard physical values used for calculations, that is a meter, a kilogram, a second, or ampere changed permanently at random?! Would it be possible to design a state-of-the-art airliner or nuclear reactor under such conditions, and could they work reliably? Obviously, if this being so, we would have to use only the most primitive tools: a moil, a stonebreaker, or a shovel, even not dreaming about excavator. Similar things happened to the economy since we have to make use of obsolete technologies, primitive criteria and tools. That is, economists like equilibrists have to build a behavior strategy based on unstable performances, to look for definiteness in the world of unpredictability.

Actually, a permanently acting “inflation tax” everyone has to pay has emerged. “Long” money is disappearing, hunting for here-and-now profit began. It becomes impossible to forecast results with confidence, or to implement unprofitable yet necessary for public projects. Everything is making shaky, blurred, and deprived of solid fundament of reasonability. This gives rise to speculation activities, integrates disproportions, and brings back to life all kinds of world and human pathology. Present-day economy becomes feeble, vulnerable, and low efficient.

The third factor of universal financial anomaly is the ability of money to bring income outside the sphere of real production. Caused by deficiency of money, by today the said phenomenon had gained universal character and taken the most refined shapes, manifesting itself like ordinary loansharking.

It has influenced the humankind history greatly. It proved to become a source of protests and suppression thereof, a great variety of wars and crimes, world and human disasters, struggle and cruelty. There is no crime committed not for the sake of money. The said phenomenon is used to constraint goods turnover, difficulties arise to receive productive income, to settle the accounts with counteragents and vendors, to pay taxes and duties, and social division of labor becomes more complicated.

Moreover, it has been found that under contemporary conditions, money might not be associated with production in general, and bring income just by the way of manipulations on the stock exchange, which is nothing but passing money from one pocket to another one. That is why, in the area of finance, a purely monetary virtual market has formed concurrently with a real commodity-money market. In such a market, production cycle duration does not limit money turnover rate, and therefore, financial rent frequently proves to be 5 or even 10 times as much as profit in the real sectors of economy. Consequently, cost of everyday transactions on the world exchange market has already reached trillion US dollars.

All this would be a farce, if the money-organization system formed in such a way performed on its own. However, virtual economy may create only virtual values. Therefore, to support its life, it enslaves the real economy to bring the latter under its interests. At that, artificially generated deficit of money, i.e. deprival of productive economy sectors of their own financial resources serve as a main tool for enslaving. Without such a phenomenon, if there were anyone to take money for interests? After all, money is the blood of economy (T. Gibbs), and deficiency of blood has never been a source of health.

Therefore, debt of all links of economic life in the world has assumed unprecedented proportions. Thus, only securitized debts of states, households, corporations and financial institutions exceeded a three-year GDP of the USA. Only for the period from 1980 through 1991, the amount of annual international bank credit has increased from USD 342 billion to 1.7 trillion. Under such conditions, banking has stopped servicing society to turn into an ordinary apparatus of loansharking. It is extremely under the illusions that such circumstances can favor increase in efficiency of public production.

At that, the said disadvantages of the present-day financial system are inevitable for the ruling financial system. They have been always existed, exist and will be exist, but now they become increasingly masked, sophisticated and destructive. To that end, any patching of the domineering financial circulation will bring to nothing. Here, we need a radically new approach. What, in our opinion, does it consist in, and what is the way of cardinal rehabilitation of the monetary and financial system?

For this purpose, let us assume that the creator of value is exceptionally human labor. In what connection, “any kind of labor that can be recognized as socially-necessary should be deemed as productive labor” (member of the Academy of Science, S.G. Strumilin). Any other factors of production, i.e. capital, natural resources, capital assets, information, etc. only represent the tools that increase productivity of human labor, without which they would be worthless. No matter how many they were, but unless animated by labor they are good for nothing. On the other hand, “…the same labor, within regular intervals, always creates equal values, notwithstanding its productive power change” (K. Marx). It stands to reason, that the value created by labor is proportional to its scale. Then the total value created in a state for a certain interval corresponds to the total working hours spent during that period by all workers.

Moreover, it would be more logical to make constant the relation between average amount of labor in a state and monetary equivalent of the value created by that labor. That is, to hold fix the said proportionality factor. For example, to suggest that the value measured in one ruble or any other monetary unit is created within one hour of public labor. In such a case, money assumes reliable labor equivalent, a sort of foundation and becomes a stable standard of value. They prove to be firmly associated with the products of labor for which money is designed to provide market servicing.

Such an approach simplifies the situation making the economic state visible and productive. Actually, division of labor demands for exchange of its results between all participants of the labor process. The exchange needs money, and in such amount that would correspond to the total value of all goods entering the market. Thus, money are directly associated with labor that created the said goods.

The approach suggested allows for taking the major instrument of market relations, i.e. money, out of control of market regulation. Demand and supply, gold equivalent, conjuncture, stock exchange gambling, state of world currencies, etc. will stop affecting par value of money. Money is certain to receive reliable and highly marketable collateral in the form of public labor producing goods it serves. Money shall become a standard of value and, simultaneously, a measure of labor. It shall be filled up with objective content independent from time or some other factor, thus getting rid of its first global disadvantage.

As a result, economy shall receive a so-termed stem, a supporting point by resting upon which it would be possible to manage all economic processes with confidence. This shall not only form a reliably operating financial mechanism, but also make all economic performances much more predictable. Then, inflation will be impossible in principle since money shall become a fixed, standardized parameter of the economic life as a whole. Therefore, the second abovementioned global deficiency of money, that is, its permanent depreciation will disappear. Inflation is certain to disappear, and money will turn from an element of indefiniteness into the factor of stability. It is impossible to overestimate the importance of this circumstance.

Indeed, universal experience testifies to the fact that the more stable the money of a state is, the more efficiently its economy performs. Only if par value of money is stable, there appears a chance of long-term forecasting, strategic management, and planning. “Long” money emerges needed to implement non-profitable yet socially necessary projects, and so on.

However, to declare consistency of labor content of money should not mean to have the same. What should one specifically do in order to preserve stability of money, and what is possible in principle?

For this purpose, let us assume that production performs only for the sake of satisfaction of needs of people, society, i.e. for production of objects of utility only. Besides, the latter ones include tangible products of labor, and services rendered, spiritual, social, and other values, that is, everything to facilitate their confident and productive life. Not only of the current generation, but of the next generations as well.

Value of all other products of labor, including means of production, capital, energy and accessories, expanded reproduction fund, etc. are included in the value of consumer goods as integral parts thereof. Let us suggest the balance of foreign trade to be optimal, i.e. zero. Physical wear and depreciation of the equipment is balanced by new and improved means of production purchased for target depreciation allocations. In this case, if the balance between the amount of labor contributed by the society and monetary equivalent thereof is constant, total value of consumer goods and services produced by society shall be inevitably equal to the aggregate value generated by social labor.

On the other hand, the equation of money circulation (Fisher’s formula) is known: . Where is commodity weights, – its average price, and letter is used to denote the money supply circulating in the country, and – average rate of circulation. Thus, production and exchange relations prove to be closely associated with financial system. The quantity of money issued is the same as the quantity needed to service the commodity weight entering the market. This means that, statistically, average price of goods will not differ from their average value.

And another thing, since all consumer items produced in the country are consumed completely (including via the fund of expanded reproduction which formation can be interpreted as the process of satisfaction of a social demand for the growth of productive forces), we can suggest that the value created in the country can be deemed its income. However, whether it can be deemed to be anything else, when social labor is productive and addresses the needs paid by the salaries received?

In such a case, not the growth of average salary will be encouraged but decrease in average price. In addition, this corresponds to the nature of things, because the true progress of production, in the first place, is connected with the reduction of expenses spent by social labor for manufacturing of consumer items, not with the growth of quantity of depreciated currencies for which the consumables may be purchased.

Then, if monetary equivalent of labor is constant, the quantity of money entering the market shall be strictly conformed with the integrated value of all products of labor, i.e. , where – integrated labor costs in the country. Consequently, integrated supply of goods shall be automatically corresponding with the integrated effective demand. Thus, the market itself shall ensure stabilization of the current unit of money.

At the same time, because of the market regulation, the products of labor with higher social significance shall have higher price, while with lower social significance – lower price as compared with individual value contributed to them. That is why if the integrated money supply entering the market is constant, the market will automatically keep track of social significance of various kinds of labor and thus, contribute to freedom from inefficient forms and structures that decrease social productivity. It is obvious that in such a case, goods manufactured by monopolists should have prices corresponding to their values.

In this regard, there emerges a possibility to specify the exact quantity of money needed for reliable servicing the economy to prevent inflation or deflation. Such an approach will lead to elimination of shortage of money, the main reason for the third global deficiency of modern currency, and its ability to serve as a source of loansharking income. The factor that has torn humankind to pieces for centuries was the principal tool of exploitation, and other pathology of human relations will stop working, provided that the aforesaid is implemented. Society will possess money enough to perform any productive activity, but no more. Shortage of money will not hinder optimization of performance of the economy, improvement of management, education, healthcare, and culture. It will equally supply military defense, science, culture, and environmental protection.

Money will serve a person instead of standing a man onto the verge of survival, suppressing his nature, blazing through everything in its path. “Excessive” labor and goods not backed by money for production or purchase thereof shall disappear. Unemployment and any other social distortions will be impossible, because every person able to work will possess a quantity of money required to produce and purchase the goods created.

On the other hand, why the quantity of money required for efficient performance of the economy cannot be supplied within the currently existing financial system, why is the shortage inevitable? After all, actually, money represents not real tangible values, oil or grain, but virtual conventionalities that can be issued in any amount whatever. How is it come that the society can be short of these conventionalities?

To get to the bottom of the said phenomenon, let us return to the above formula of Quantity Theory of Money. The rate of circulation of money may serve as the most informative value to answer the question. What is this factor, and how is its value determined?

The product represents a value equivalent to GDP (gross domestic product) of the country in terms of money. In this regard, we can suggest that , i.e. the rate of monetary circulation shall be determined not by the quantity, but a relative value as compared to GDP. That is why the inflation factors while causing growth both of money supply, and GDP, affect the rate of circulation of money insignificantly. To this, some other factors are applied.

Actually, average rate of circulation of money depends, in the first place, on the state of the economic system and its ability to process monetary resources in a variety of forms without inflation. Indeed, let us consider the rates of circulation of money in various countries of the world (Table 1). It implies that the more dynamically the country develops, the slower the rate of circulation is (!), and the economic system is able to process money supply of greater scale, not accompanied by inflation. Therefore, it would be a mistake to suggest that the key reason for inflation is determined by excess of money in the economy, not its underdevelopment or obsolescence.

Table 1. Average rate of money circulation in 2007

| Countries | Japan | China | Canada | USA | India | RSA | Brasil | Russia |

| 0.5 | 0.685 | 0.7 | 1.27 | 1.47 | 1.59 | 1.7 | 4.39 |

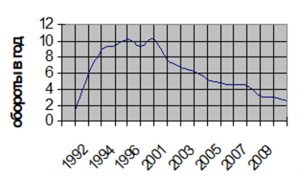

On the other hand, the income brought by money depends on the circulation. Important, though apparent conclusion can be deducted that the faster money circulate, the greater shortage is experienced, the more significant the profit it earns, and the economy of the country works more poorly. However, it is not always evident where the cause and effect are. Notwithstanding, the said regularity works rigorously. To demonstrate the regularity, the flow chart for average rate of circulation of money in post-reform Russia is provided (Fig. 1).

The flow chart implies that in the most turbulent years, when inflation and a complete breakdown of law and order actually crushed all real values in the country, money was circulating in the fastest way, which means that its profitability was maximal. However, as far as at least some order was established, that rate began decreasing.

How does it work in practice? To make head or tail of that, let us distinguish several sectors of economy with admittedly different rates of money circulation. Among them, the following sectors are the most distinctly pronounced.

- Trade, service, finances, crime. This sector not only distributes all money supplied to the market, but also provides circulation of the primary cash flows in the country. Besides, the said sector renders services, it features shadow and virtual economies, speculative and criminal gains are circulating, and illegal incomes are laundered. Plus, a considerable part of the functions mentioned above is not directly associated with performance of somewhat obligation of public utility, this does not require significant time and labor consumption, thus ensuring the fastest goods and money flows.

In this regard, the said sector to the utmost extent influences the magnitude of average rate of circulation of money. Therefore, the more human and competitive this sector is, the less scope of shadow and virtual economy, the less considerable cash flows pass through criminal channels, and the slower circulation of money are. In addition, it accelerates the average rate of circulation of currency of the country to the least extent.

- Real production, where the rate of circulation of money is limited by production cycle duration. For example, duration of circulation of money invested in construction of a ship is two years, that is, the duration of construction as such. In agriculture, duration of circulation of money cannot exceed the frequency of harvesting.

From this it follows that the rate of circulation in a real sector of economy cannot be high. Tis is quite understandable, since it depends not only on the time of manufacture of the product proper, but also on the rate of resource production, time of the processing, storage, transportation, preparation of semi-finished products, manufacture of means of production, delivery to the consumer, and so on. In this respect, the more sophisticated the product in terms of technology, the longer term of production it has, and the lower the rate of circulation of money employed is.

Developed economies implement social division and cooperation of labor largely. That is the reason for more complex organization and slower movement of cash flows. Considerable resources are employed for the development of advanced technologies and modern equipment, for high-level processing of raw materials and manufacture of goods with significant value added. While underdeveloped economies primarily focus on the goods that underwent simple refining, extraction and export of poorly processed raw materials, craft industry, and low level of cooperation.

- Innovative sector that contributes to the economy in the form of scientific achievements, knowledge, trained personnel, state-of-the-art technologies, production and protection facilities, environmental measures, etc. It is responsible for demography, health of the nation, physical, moral, intellectual and spiritual upbringing young generation and all population. This sector is meant to provide production with all necessary for efficient performance.

The listing itself speaks for the fact that the production process here is quite time consuming, and the rate of circulation of funds cannot be high. Therefore, the greater the proportion of this sector, the slower money circulates in the country.

- Accumulation sector. Here, not only amortization and investment resources, or money saving of the population are condensed, but also their pension funds are accumulated, and money of the insured persons is stored. That is why due to the slow circulation of money (approximately one circle for 20 years) serves as a natural reservoir for financing of long-term innovation projects, for supply with funds of unprofitable yet necessary works. However, in the present-day economy it has turned into a cheap source of money for business projects.

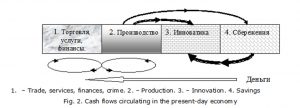

These areas of economic activities are shown in Fig. 2. To denote the financial flows moving between and inside the said sectors, arrows are used.

- – Trade, services, finances, crime. 2. – Production. 3. – Innovation. 4. Savings

Fig. 2. Cash flows circulating in the present-day economy

Accordingly, the money sent to free floating is inevitably to rush to where its rate of circulation, and therefore, profitability is higher. That is to financial institutions, trade, brokerage, and crime. While the sectors of production and innovation get short of money to service them. Under such conditions, additional funds from under the printing press again move to the same commercial sector, already supplied with enough money. Consequently, the additional money indeed become a source of inflation, while the rest sectors of economy, all the same, are left without money needed.

Table 2.

Current assets coverage for the Russian enterprises, by year

| Years | 1994 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

| Current assets, % | 14.2 | -17 | -11.9 | -7.4 | -7 | -6.6 | -8.2 | -10.6 | -12.5 | -13.3 | -10.5 |

Такая информация предоставлена Росстатом и приведена в Таблице 2. Actually, specifics and seriousness of the situation as it has developed in the real economy of Russia allows for revealing the current assets coverage at the enterprises. The latter represents a balance between available and required current assets for enterprises and organizations. This information is provided by Rosstat (Russian Federal State Statistics Service) and given in Table 2.

The figures shown testify to the fact that overwhelming part of contemporary Russian enterprises (except for those engaged in extraction of minerals, servicing foreign manufacturers of goods, production and distribution of electric power, oil, gas, and water) not only deprived of funds required for proper performance, but even are heavily in debt. Therefore, they have to make use of quasi-money, offsets, or arrears in payment of various kinds. They are not able to form current assets for borrowed funds, because the rates on credit provided by the Russian banks frequently exceed the profit the enterprises earn at the expense of the loans obtained. Undoubtedly, all this impairs significantly their competitive power.

Therefore, the Russian enterprises of the real economy sectors actually have become bankrupts. They languish in misery unable neither to provide themselves with skilled labor force, or neither modern equipment, nor they protected against bribery racket or corporate raiding. At the same time, it is the real sector that makes foundation for any national economy, because the currently promoted greatly financial sector can create only cash incomes. Under current conditions, without foundation, growth of the country, the human well-being, and secure future are impossible. That is the reason for unavailability of domestic products on the shelves, and the population is unable to earn a decent living. Thus, the situation has already run out of control of individual enterprises; and to resolve the situation target-oriented government intervention is required. However, there is no the slightest hint of the same.

To resolve somehow this collision, the entrepreneurs employed in the real sector have to, against their own will, organize production where circulation of money can be accelerated. That is, to produce primitive products, limit the scope of works sophisticated in terms of science and technology, sell unfinished goods and so on. Such “economy” leads to the increased rate of circulation of money in the production sector, and, concurrently, to level the technology down.

On the other hand, the problem of outflow of funds from the real economy within the existing financial system is inevitable. It exists not only in Russia, and has arisen not today. However, while the developed countries have a system of measures up and running to level the incomes in various sectors of economy in order to maintain consistent rate of profit, there is nothing similar in post-colonial countries. Moreover, the advanced countries enterprises save their current assets, so that mere reproduction of capital funds could be paid for out of amortization savings. To add to this, in the USA, tight standards of minimal allowances for reproduction of capital assets have been established, and the Ministry of Finance enforces them strictly. Meanwhile, the Ministry of Finance of Russia does not practice the same at all. And this takes place when current assets of the Russian enterprises are eaten by hyperinflation, squandered away by the owners, and there is no possibility to restore them.

Resources needed for expanded reproduction are essentially less than those required for reproduction on a simple scale. Thereupon, in developed countries they are drawn either out of own profit, or through attraction of investments, comparatively not expensive banking loans, or by introducing securities of various kinds. Many large investment projects are implemented at the expense of the state budget. All this considerably blunts the acuteness of financial problems of enterprises. There is nothing similar in undeveloped countries, with all that it implies. Amortization savings are guzzled away, simple production is complicated, and current assets are insufficient. Thus, the problem is acute for every state of the world.

This implies that one of the primary goals of administrative management is organization of such economy that may enable it to consume maximum quantity of money avoiding inflation. Achievement of such a financial order when shortage of money is reduced to minimum, and at the same time, there is no excess of money.

In this regard, let us consider in detail the model of circulation of money given in Fig. 2. According to this pattern, economy is divided into sectors with significantly different duration of production cycles. At that, while the first sector is meant for distribution of consumer goods, the second one performs productive or creating function. Its mission consists in providing the nation with all necessary things. The third sector forms favorable conditions for the first and second sectors to perform efficiently, and the fourth one serves as a means of accumulation and support. Each one is important, it is impossible to do without any of them.

Under the conditions of market economy, using in different sectors of the same money that is tied to nothing is unproductive. Since it inevitably become easy enough to flow where its turnover, and thus, profitability, is higher. Consequently, sectors with lower rate of circulation always work under the conditions of shortage of money. It is obvious that no legislative or administrative bans can suspend the process. Money not associated with anything real and sent to free floating will always find its way where the income it brings is the highest.

In the USSR and other socialist countries, the function of “slow” money was successfully assigned to non-cash money, with a rate of circulation and a possibility to change them into cash rigidly constrained. All innovations were paid for out of the budget or through planned supplies. That is why the socialist financial system was the most steady of all systems then known. It was affected by neither errors of the government, nor trading, political, nor conjuncture fluctuations of the world market. It is a dream of a system for serious businessmen all over the world. Notwithstanding, replacement of that system by a more archaic form that is characteristic of its present appearance has resulted in loss of all advantages mentioned above.

Therefore, the experience of the Soviet financial system shown that refusal from singleness of money, i.e. using different money to service production and consumer markets can save many troubles typical of current monetary circulation. Rigid reference if non-cash money to labor, and hence, to the production cycle add it sense, weight, and stability, depriving it of superficiality and irresponsibility typical of contemporary money. Such a tying in shall make it serve the right purpose instead of following its light-minded whim. Its uncertain nature stops affecting destructively behavior of people. Money is restricted by the trace of service to the benefit of society, troubles reducing significantly.

Let us consider the possibility of applying the said experience to the real market life. For this purpose, let us proceed to some other scale of estimate and pay attention to functional intended purpose of money. At that we can see that all human activity is subordinated to two giant cycles, in one of which money is earned, while in the other one – spent. Within the first cycle, consumer goods are produced, while in the second one, they are consumed (it is to be recalled that only consumption is an ultimate goal of production). Therefore, it makes sense to use two kinds of money, one of them should be used to service exceptionally production market, while the other – for the consumer market only.

In other words, let us suppose that all production costs, including remuneration of labor of those employed in production and distribution, or in art, as well as all transport, power generating, storage, scientific and research, design, banking, advertisement, security and any other expenses incurred by all structures shall refer to the production financial circle of turnover. Through the agency of this circle, raw materials, accessories, energy are paid, equipment is purchased, and capital assets are renewed. While the consumer monetary contour ensures spending of the income earned by those employed in the structures mentioned above.

At the same time, the production circle, like in the USSR, should be serviced by non-cash money, while the consumer circle – by cash. However, unlike currently existing non-cash money, the money suggested, in its essence, form the current assets of enterprises and organizations. It is meant exceptionally for the payment for production costs, including creation of the fund of expanded production. Now, special money to carry out the functions described above is absent. However, according to the best case scenario, cash money shall be used for retail trading only and derived from the exchange for non-cash money. In such a case, intended purpose of cash money shall be similar to M2 money supply currently used.

This is where the two circles of monetary turnover differ. One kind of money cannot be applied in the area of use of the other one. Then, the key problem is how to arrange interaction of both money flows. It is evident that without coordination, or without naturally mutual transformation of one kind of money into the other one, the financial system created in such a way will not be able to operate smoothly. In order to provide smooth operation, neither kind of money can exist apart from the other.

In the Soviet financial system, cash money could be transferred into non-cash funds according to rigorous standards. Even the bonus budget was highly restricted. That is, independently from the scope and quality of the work performed, enterprises had no right to pay the employees bonuses exceeding the limit of salary established. On the one hand, it contributed to stabilization of the monetary system of the country making functionally referred to the real economy. On the other hand, it separated performers from the performance outcome depriving them of interest in raising labor efficiency and product quality. This contradiction turned out to be fatal, giving birth to low competitive power of the Soviet enterprises and unsatisfactory quality of the goods produced.

Here, let us pay attention to yet another aspect of the problem under consideration . Since economy aims at satisfaction of needs of people, and the result of its activity are the consumer items only, the production sector acts as a seller, while the consumption sector is a buyer of the goods produced. Therefore, the amounts the consumption sector pays to the production sector are always equal to the total cost of the consumer goods the production sector delivers to the sector of consumption. In other words, producer of goods in a state can realize a sum equal to that paid by the consumer, and it cannot be otherwise. In this respect, money supply to service consumption and production circulations in the economy, with the rate of circulation of money in the said sectors taken into consideration, prove equal (!). This may serve as evidence for the necessity and possibility of maintenance of equivalency of market exchange of goods between all structures of the economy, and of adherence of both kinds of money to each other.

In such a case, net income or balanced financial result of the state is equal to the money supply multiplied by the rate of circulation, where money supply works either on the production, or on the consumption market (!). Then there is no medley of sectors of production, consumption, services, speculation, rent, rental payments, and so on, like with calculation of the current GDP. There is a clear distinction between production and consumption, apples and oranges. It is clear what to encourage but what to constraint, what good, and distinguish between good and bad, between progress and regress. At that, the types of supply of people that cannot be referred to each other shall be serviced individually by its own money, and there will be established some plausible order.

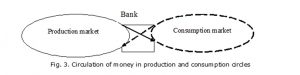

In this case, stability of labor content of money shall be provided repeatedly. On the one hand, it is to be defined by size of labor force in the country, and the average earnings, on the other hand – by the balance of money flow involved both in production and consumption markets. This allows for organization of self-regulated functioning of both markets of circulation of money, and natural transformation of one kinds of money into the other ones under the market conditions as shown in Fig. 3.

This means that if goods are meant for the real economy (i.e. represent a means of production, procurement, heating power generation, etc.), they can be sold for on-cash money, and if they come into the consumer market, then for cash only. Since money proves to be rigidly tied up to the goods it serves, the rate of circulation in the production circle shall be automatically determined by duration of the full production cycle, while in the consumption cycle – by time of marketing the goods and velocity of money flows. This fact is displayed in Fig. 3 by return of a part of non-cash money back into the production circle of turnover, while the rest is exchange via the Bank into cash money.

Fig. 3. Circulation of money in production and consumption circles

Similarly, on the consumption market, a part of cash money is spent on purchasing goods from enterprises manufacturing fast moving consumer goods, while the rest returns to its own market. And this not only enables equivalent transfer of money from one form to the other, but also different rates of circulation remains unchanged. This fact makes both kinds of money equal, demand and supply being mutually coordinated, and therefore, they will be exchange on the market automatically, without the necessity of direct administrative intervention or without discount.

The Bank serves as interlink between both financial markets. In that event, the Bank will not only supply both circles of financial circulation but also regulate them. It will become an instrument of control over correct operation of both money flows. The result is that financial violations will be controlled in the same place where all these flows inevitably cross, i.e., in the Bank, instead of being monitored in all structures. Such Bank becomes one of the most important instruments of public regulation of an enterprise of any pattern of ownership under the market conditions.

It should be noted that the flow chart of Fig. 3 is similar to the human blood circulation system, where the part of small circle corresponds to the production market. Blood is being enriched with oxygen in the same way as non-cash money is replaced by goods manufactured with its aid while passing the production circle of circulation. While the part of large circle is played by the consumption market (blood gives oxygen to the body, like goods sharing their consumer properties with the population and transformed into cash money). That is why this pattern of financial circulation corresponds to a highly advanced production as the blood circulation system of a human body corresponds to the perfect natural body. This means that the system is natural, efficient, and ultimately reliable.

Making use of the given conclusions, we can connect average rate of circulation of money in the country with money supplies , and their rates of circulation in the production 1 and consumption 2 circles of market circulation. The following relations are resulted:

. (1)

With this, for all structures of the economy the condition holds.

Moreover, the confidence arises that all abovementioned actually works in the current economy as well. This does not depend on whether it is known or not, whether it is used consciously or it is concealed behind selfish or sincere mistakes. This is quite logic, because all regularities considered above are derived from nature of the real economy rather than being a phantom of imagination. So, the approaches employed can be also applied to analysis of the current state of the economy. Not only in Russia, but also in any other country of the world.

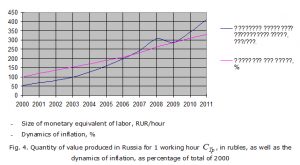

In particular, using the statistical data generated by the Rosstat of the Russian Federation, let us make an effort to specify the value , i.e. the labor equivalent in the present-day Russia. For this purpose it is not unreasonable to suppose that productive efficiency of labor is measured by GDP of the country in current prices. Notwithstanding the fact that this criterion, from the perspective of all abovementioned, is not correct enough, there is no another measure of labor efficiency that would be more precise. In this regard, size of labor force of the country is determined based on the corresponding statistical data, while average number of working hours of one employee shall be taken as 2,000 hours per annum. Then we obtain the relations shown in Fig. 4. In the same figure, dynamic of inflation in Russia is shown as compared with 2000, expressed in percent.

- Size of monetary equivalent of labor, RUR/hour

- Dynamics of inflation, %

Fig. 4. Quantity of value produced in Russia for 1 working hour , in rubles, as well as the dynamics of inflation, as percentage of total of 2000

Some curious facts have been revealed at that. It turned out that since 2000 through 2011, the labor equivalent of a ruble has increased by a factor of 7.5, while depreciating through inflation only by 3.3. It has been noted that the US dollar has depreciated approximately by 3.3 for the same time. The concurrency is observed not only at the decade-end, but also at every year-end. This is how much actually depreciated the Reserve Fund so reverently accumulated by the Government of the Russian Federation. Understandably that the coincidence mentioned is by no means occasional, since due to quite tight reference of ruble to dollar (from 2000 to 2012, the ruble to dollar ration has changed from 27.03 ruble/dollar to 29.08 ruble/dollar), this could not be otherwise. For the same time (up to 2010) import to Russia has increased by a factor of 5.54, while the foreign trade balance has grown up to USD151.7 billion per annum, i.e. 2.52. The real production (from 2005 through 2010) decreased by a factor of 0.964 with simultaneous increase of agricultural output by 1.842. There is something to think about.

Thus, what the country has gained from instability of monetary equivalent of labor is obscure, and does the economy need such uncertainty – is open to question. Besides, the values of factor obtained may be applied not only for estimation of the state of the economy of the country as a whole, but also of performance of any industry of the same. This factor can also be used for objective estimation of current prices, especially set by natural monopolies, for control of salaries, various emoluments, etc. At present, the latter are set by subjective comparison of demand and supply, which not always reflects real value thereof.

It should be noted that in the equations given, a condition of obligatory application of two forms of money is absent, which means that they can be also used for the estimation of current state of financial market. It is quite expectedly, because there is no principal difference between cash and non-cash money suggested herein. The only difference is that one of the forms is referred to production, while the other one – to consumption. With that, work of money in the other circle of turnover should not be admitted. In Fig.5, corresponding calculations made based on equations (1) and Rosstat’s data are presented.

Number of circles per annum

– Average

— Production

– – Consumption

Fig. 5. Rates of circulation of money on the production and consumption markets of Russia, by years

It follows from the analysis of the curves obtained that over the years, production to consumption money ratio is increasingly approaching to that one in the developed countries. Thus, if in 2000 the production made 6.29 circles per annum, then by 2009 – 1.68 circles per annum, i.e. it became slower by a factor of 2.69. As to the consumption circle, circulation of money has decreased from 27.5 circles per annum to 10.3 circles per annum, correspondingly, that is by 2.69. While in 2000, the quantity of money employed in the production was 4.38 times more than in the consumption, in 2009 that value increased up to 6.13. The said circumstance is attributable to reduction of rates of both circles and convergence of profits money brought in different sectors of economy.

It should be noted that the scale of the system is not restricted, and thus, this structure of monetary circulation is able to operate in any quite large space or production cooperation. That is it can be applied both in a state in whole, and in large cities, regions, within quite large enterprises and associations. Moreover, it is the way that it should be implemented.

Use of non-cash money for servicing the real economy offers a number of advantages and allows for solving tremendous number of problems. In particular, the absence of current assets stops being a cause of shutdown of productions enterprises. They are able to pay with non-cash money for the supplied accessories and power, heat and semi-finished materials, pay taxes, b exchanged into cash money for paying salaries, etc. timely and to the full. Consequently, full-scale market relations start to perform reliably not only in distribution but also in production. Non-cash money can circulate without bearing a risk of loss, delay, unintended waste (see in detail in monographs [1]-[4]).

It will be impossible to rend non-cash money from labor resources, steal, or sell for cash unless necessary for production, exchange into currency, or hide from taxation. Therefore, such money, alongside with other advantages will serve as a powerful factor for recovery of economy and business environment as a whole. It will bring enterprises out of shadow business (organizations will not be in a position to deal with the others outside the Bank, so they will have to obtain legal status). Since non-cash funds are closely associated with cash, the said circumstance will favor stabilization of the economy and all production relations. “Envelope salaries” currently used by the major part of the Russian enterprises to settle with their employees will disappear. All this will increase tax base, raise efficiency of tax services and facilitate tax police activity. Foreign investments will be needed just in the form of equipment, technologies, and accessories, which can be used with the own money.

Such means of payment may be presented in electronic format and provided in any form not prohibited by law, that is, in the form of offsets between enterprises and organizations, offset standard, warranty or insurance certificates, securities and promissory notes, and any other financial instruments. In so doing, fiscal meaning of money introduced is not an ultimate purpose of the project. Therefore, the benefit of a state or any other economic structure obtained through this implementation will consist, in the first place, in improving efficiency of performance of all links of the economic system.

In this respect, non-cash money suggested for the forming of current assets of enterprises are apparently the simplest and the most reliable solution. Indeed, such money cannot be stolen, drawn out beyond enterprises, or used for purposes other than that intended. At the same time, it will provide enterprises with everything required for highly efficient operation. After all, enterprises need only what is required to operate rather than money itself. Specifically, labor force, raw materials, equipment, electric power, and components. An enterprise shall not be concerned about a way of payment for the same. Introducing non-cash money will not lead to inflation since the real sector actually has been left without money to service it. Non-cash money is controllable and easy to manage, so it cannot cause somewhat unregulated processes.

Such money can be provided to enterprises without charge for interest, or even as unreturnable loans. This will help to establish full-scale market relations in the production circle, get operation of enterprises running according to their competitive powers, offer people an opportunity to work and live properly, and also receive immense incomes through which it could be possible to reduce tax burden and increase budget revenues both of a country as a whole, and all the regions, particularly.

Such an approach results in growing role and functions of banks. Actually, it is unnatural when the main purpose of banks that are the heart of a financial system consists in making fortune of their own instead of servicing a body for which they are intended and which activity they feed. Still, this trend is observed in modern commercial banks. In realizing all above mentioned, welfare of banks at the expense of the nation will be impossible.

It’s estimated that due to integration of the said money and better performance of economy the budget of the country will double for several years. The only thing the state is to pay for this is provision of the real sector enterprises with current assets, revival of national economy, elimination of unemployment and improvement of standard of living of all the citizens.

References

[1]. Chabanov V.E. “Problems and Ways of Reorganizing the Economy of Russia”. Publishing house Olbis, Leningrad, 1997, 242 p.

[2] Chabanov V.E. “The Economy of the 21st Century or the Third Way of Development”. Saint Petersburg “BHV-Petersburg”, 2007, 735 p.

[3]. Chabanov V.E. “Introduction to the Fundamental Economics”. Publishing house of the Polytechnical university, Saint Petersburg, 2011, 298 p.

[4]. Chabanov V.E. “Principles of the Fundamental Economics”. Publishing house Economics, Moscow, 2011, 182 p.