- The discovery:

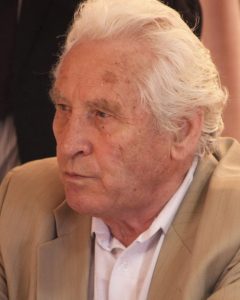

Chabanov Vladimir Emelyanovich. Doctor of Technical Sciences, Doctor of Philosophy and Physics CFD (IUFS).

Date and place of birth: January 15, 1938, Aktyubinsk.

Nationality and Residence: Russia, St. Petersburg, 198207, St. Petersburg, Stachek pr., 122, flat 15.

- Jayasekara Shanti Pushpakumara. IHAC president at IUFS, IUFS Rector, Professor, Doctor.

Date and place of birth:

Nationality and residence:

- The distribution of authors’ property rights

Chabanov Vladimir Emelyanovich – 51%;

Jayasekara Shanti Pushpakumara – 49 %.

III. An indication of the field of science which the discovery refers to:

The discovery refers to the fundamental economic, section “Economy”.

- Name of discovery:

“Harmonious financial system”

- Opening Date

July 7, 2013

- Summary of Discovery

It is well known that the state of the modern global financial system is unsatisfactory. Existing funds have complex defects, which impede to make effective use of them to enhance the productivity of labor, natural, intellectual and human resources, to create equal conditions of international trade. They hinder the development of public and private economic structures, improve social productivity of labor and the standard of living of the population. As a result, all without exception occurring global and national crises are financial.

To create an effectively functioning financial system, a method of imparting the labor content of the national currency is developed, giving them the objective content. It is proposed to introduce two forms of money, one of which is intended for production facilities, and the other – consumption. The quantitative relationship between them is defined.

VII. Discovery Description

- The current state of the financial system

Money is a key element of the whole existing economic system. However, in most of the countries in the world the present state of finances is unsatisfactory. They are in debt, for which they are required to a large part of their income. Their money has low purchasing power, resulting in their own products are sold for prices lower than the real value, and foreign are bought for more expensive value. Investments in these countries are inadequate. In addition, they are usually not directed to those industries which require the development of the state, and are engaged in the production and export of raw materials or generate large profits no matter what damage is done to this environment, people and the country.

On the other hand, the key economic characteristics (income, interest rates, exchange rates, etc.) are currently determined by the interests of financiers, not producers. This leads to washing away of money from the real economy, to devastating structural changes, distorting national economies. Economy leaves the service of the national interest, no longer serves the entire population, and mainly owners of bank notes. And not only in personal, but also in a national scale.

However, the money – it’s not a hard, fixed substance, which does not change with time. In fact, money is the most visible display of the existing public relations, product and at the same time due to all the processes in the country. Therefore, they dynamically modify, and adapt to the situation, mimicry. Their functions, forms and content change. Thus, until recently, the money have had gold backing. And that was the objective factor, allowing regulate different currencies, was the key to the World Order. However, a complete abandonment of the gold parity of money held in the seventies, has destroyed this fragile element of international stability. As a result the only a form was saved from the former money, their content has changed dramatically. And now the money increasingly serves as a tool of redistribution of wealth than a reliable intermediary trade with the existing division of labor. The money serves as means of obtaining personal income rather than obtaining the common good.

In this regard, modern money has a number of disadvantages that can not be eliminated under existing economic doctrines. They are:

- The absence of objective contents of any and all currencies. As a result their face value is not determined by the real purchasing power, but information, monopoly, political and often military pressure of the developed world. By organized competition which only the strongest currencies can win from. Money became a toy of policy, passions, speculative gaming, conjuncture environment international expansion. So what now the dollar, euro, yen or ruble is no one knows. Hence, there was a huge financial rent which poor countries pay the rich. This led to the unbalance of market relations, has caused an unprecedented use of weak economies by strong, raised the standard of living of the population of developed countries and put all the others on the brink of extinction;

- Unpredictable, permanent devaluation of national currencies, everywhere present sluggish or fast current inflation. However, the money – the main tool of all business processes, measuring their results, and so in these circumstances the economy is poorly predictable, poorly controlled or unstable, and all its indicators – doubtful. Hence the “long money” disappears; causing long-term project financing to become unprofitable and risky. There was an ongoing “inflation tax”, which is forced to be paid by everyone. It violates all the principles of safe working of market regulation, does more damage than if in the technique of a meter, kilogram or a second started to change arbitrarily. It makes the modern economy weak, easily vulnerable and with low productivity;

- The ability of money to generate income without taking part in the process of useful production, creation of real values. Caused by its shortage and manifesting itself as an ordinary loan-sharking, to date this phenomenon has become universal in nature and adopts the most sophisticated forms. This fact not only was the main cause of exploitation of all kinds of diseases in human, social, economic and international relations. It led to the emergence of speculative capital, contributes to the scarcity of money, i.e. to the cash shortage, which affects all production. In fact, after all, money is blood of economy, but anemia has never contributed to health. This leads to the washing money away from the real economy, to the emergence of a specific virtual economy, where money is bringing income by just shifting from one pocket to another.