By Prof. Manjula Ranasinghe

Introduction

Behavioral economics is an interdisciplinary field that blends insights from psychology with economic theory to better understand how individuals and organizations make decisions. Unlike classical economics, which assumes rational actors who always maximize utility, behavioral economics recognizes that decision-making is often influenced by cognitive biases, emotions, heuristics, and social norms. In business environments, especially within cost management, these behavioral tendencies can significantly impact financial outcomes.

Cost management involves planning, controlling, and reducing business expenses to improve profitability and efficiency. Traditional approaches assume that managers act rationally when evaluating costs, forecasting budgets, or making investment decisions. However, empirical research shows that even experienced professionals are not immune to psychological distortions. For example, they may underestimate future costs due to optimism bias or continue investing in a failing project due to the sunk cost fallacy.

Understanding these behavioral patterns is essential for corporate leaders and finance professionals. Behavioral economics offers a more realistic lens through which to examine cost-related decisions, helping firms avoid predictable errors and enhance strategic financial planning. By identifying and mitigating cognitive biases, organizations can make more informed, rational, and effective cost management choices, ultimately supporting long-term business sustainability and performance.

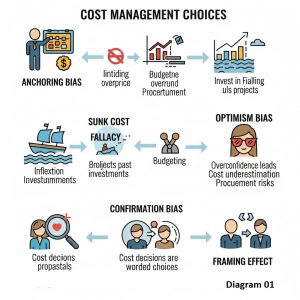

Critical Cognitive Biases Affecting Cost Decisions

In the realm of business cost management, decision-makers are not always perfectly rational. Behavioral economics highlights that various cognitive biases often cloud judgment, leading to suboptimal or even damaging financial decisions. Understanding these biases is essential for mitigating their negative effects and improving the accuracy of cost-related decisions.

- Sunk Cost Fallacy

The sunk cost fallacy occurs when managers continue investing in a project solely because they have already committed significant resources to it, regardless of the project’s future viability. This bias leads to poor cost management by promoting irrational perseverance. Instead of cutting losses, businesses often escalate their commitment, resulting in further financial damage. For example, a company might continue funding a failing product development project simply because millions have already been spent, even though future returns are unlikely.

- Anchoring Bias

Anchoring bias refers to the human tendency to rely too heavily on the first piece of information encountered when making decisions. In cost management, initial budget estimates or past expenditure figures often become anchors, even if they no longer reflect the current situation. This can cause managers to underestimate or overestimate new project costs, leading to either overspending or underfunding. For instance, if the previous marketing campaign cost $100,000, managers might anchor to that figure and fail to consider market shifts that require either a higher or lower budget. - Overconfidence Bias

Overconfidence bias leads individuals to overestimate their knowledge, predictive abilities, or control over outcomes. In cost estimation and financial forecasting, overconfident managers may ignore risks, overlook cost inflation, or underestimate resource requirements. This can lead to under-budgeting and inadequate risk buffers, ultimately disrupting project execution and financial stability. Overconfidence is particularly dangerous in start-up environments or innovative projects, where uncertainty is high. - Confirmation Bias

This bias occurs when individuals selectively gather or interpret information in ways that confirm their existing beliefs. In cost management, this can lead to the dismissal of critical cost warnings or alternative strategies that contradict a favored plan. A manager invested in a particular cost-saving strategy may ignore data showing its ineffectiveness, continuing to support it based on biased interpretation. This not only skews decision-making but may also lead to losses from ignored red flags. - Loss Aversion

Loss aversion describes the human tendency to prefer avoiding losses over acquiring gains. In financial decisions, this can result in risk-averse behavior that limits cost-saving innovation or leads to clinging to outdated practices to avoid short-term losses. For instance, a company might resist automating a process that would save money long-term due to the short-term costs and staff reductions involved. While caution is sometimes prudent, excessive fear of losses can prevent needed transformation and cost optimization. - Status Quo Bias

The status quo bias compels decision-makers to prefer existing conditions over change, even when change could reduce costs or improve efficiency. This bias often manifests as resistance to adopting new technologies, restructuring teams, or eliminating redundant processes. Managers might stick to outdated procurement processes because “they’ve always worked,” ignoring data supporting more efficient, cost-saving alternatives. - Framing Effect

How options are presented, or “framed”, can significantly affect decisions. In cost management, presenting a situation in terms of potential losses (e.g., “If we switch suppliers, we might lose quality”) rather than gains (e.g., “We can save 20% by switching suppliers”) can sway decisions away from rational economic logic. The framing effect can distort evaluations of cost-saving opportunities and lead to overly cautious or misaligned decisions.

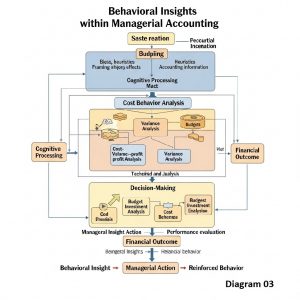

Behavioral Insights in Managerial Accounting

Managerial accounting, traditionally grounded in quantitative analysis and objective data, has increasingly incorporated behavioral insights to better understand how decision-makers interact with financial information. Behavioral economics offers a lens through which we can assess not just what decisions are made, but why they are made, especially when those decisions deviate from rational expectations. The integration of these insights into managerial accounting allows organizations to develop more realistic, human-centered approaches to cost management and control.

- Understanding the Human Element

Managerial accountants are not just number crunchers; they are interpreters and communicators of financial data. Their effectiveness often hinges on how information is presented to managers and whether it aligns with the decision-making psychology of those managers. Behavioral insights help illuminate how perception, emotion, and social dynamics influence how cost reports, forecasts, and budgets are received. For instance, a manager may favor short-term savings over long-term investments due to a present bias, even if the latter would yield higher returns. Understanding this bias helps managerial accountants better frame their reports to support more balanced decision-making. - Choice Architecture and Cost Reporting

The way information is structured, known as choice architecture– can significantly influence decisions. Managerial accountants can use this knowledge to design cost reports and dashboards that highlight key data points, clarify trade-offs, and minimize information overload. For example, presenting cost-saving opportunities in comparative formats or using visual cues like color-coded thresholds can direct attention to areas of concern or opportunity. These subtle nudges do not manipulate decisions but guide managers to more thoughtful and informed conclusions. - Budgeting Behavior and Psychological Contracts

Behavioral research also reveals that budgeting is not a purely technical exercise but a social one. Employees often view budgets as psychological contracts– informal agreements about expectations and resource commitments. When managerial accountants impose rigid budgets without considering team morale, trust may erode, leading to behaviors like budgetary slack (intentionally underestimating revenues or overestimating costs). Recognizing these dynamics allows for the creation of more flexible, participatory budgeting processes that align with both organizational goals and employee motivations. - Incentives and Behavioral Traps

Incentive systems designed to control costs can sometimes backfire due to misaligned motivations. If managers are rewarded solely on cost-cutting metrics, they may delay necessary expenditures or underinvest in quality, which can harm long-term performance. Behavioral insights remind managerial accountants to consider goal congruence, ensuring that performance measures promote not just cost reduction but overall organizational effectiveness.

Impact on Corporate Cost Management Practices

Behavioral economics significantly influences how cost management is conducted in corporate settings. By understanding the behavioral patterns that affect financial decision-making, organizations can improve processes such as budgeting, procurement, and capital investment. Cognitive biases and psychological tendencies, when unaddressed, often lead to inefficiencies and errors in cost control mechanisms.

- Budgeting and Forecasting Errors

One of the most evident impacts of behavioral economics is in the area of budgeting and forecasting. Managers often exhibit optimism bias, leading them to underestimate costs or overestimate revenues in budget projections. This overconfidence can cause resource misallocation, unrealistic target-setting, and eventually, unmet financial expectations. Additionally, anchoring bias – the tendency to rely heavily on the first piece of information received – may lead managers to stick closely to previous budgets, even when conditions have changed significantly. Such reliance can hinder adaptive decision-making, especially in volatile markets. Forecasting errors may also stem from confirmation bias, where decision-makers seek data that supports their assumptions and ignore contradicting evidence, leading to flawed cost predictions and poor strategic planning. - Procurement and Supplier Negotiations

Procurement decisions, often involving complex negotiations, are vulnerable to several behavioral influences. For example, loss aversion may cause managers to stick with familiar suppliers even when better alternatives are available, simply to avoid the perceived risk of change. This behavior, although emotionally comforting, can result in missed cost-saving opportunities. Furthermore, framing effects in supplier negotiations, where the presentation of information influences decisions – can skew the evaluation of pricing models or contract terms. A discount framed as a “limited-time offer” may pressure a company into unnecessary purchases. Additionally, reciprocity bias can cause procurement officers to favor suppliers who have previously offered gifts or favors, compromising objectivity and cost-efficiency. - Capital Investment Decisions

Capital budgeting decisions are especially susceptible to behavioral distortions, given the high stakes and long-term implications. Sunk cost fallacy – the reluctance to abandon a project because of already invested resources – can lead companies to continue funding unprofitable ventures. This can drain financial resources and hinder investment in more viable opportunities. Status quo bias may also lead to the rejection of new technologies or innovations that could improve operational efficiency, simply because they differ from traditional practices. Moreover, when evaluating capital investment options, availability bias can result in decisions based on easily recalled but unrepresentative data, such as recent project outcomes, instead of a thorough cost-benefit analysis.

By acknowledging these behavioral patterns, corporate leaders can improve cost management frameworks, incorporate checks and balances, and foster a culture of rational and evidence-based financial decision, making.

Empirical Case Studies & Research

Empirical studies and real-world examples provide strong evidence of how behavioral economics influences cost management decisions in both public and private sectors. These studies reveal recurring cognitive distortions that shape investment behaviors, budget forecasts, and overall financial planning.

- Public Investment Studies: Cost-Benefit Distortions

Empirical research in public sector investment projects frequently uncovers significant misjudgments in cost-benefit analysis due to behavioral factors. A widely recognized example is the consistent underestimation of costs andoverestimation of benefits in large infrastructure initiatives. According to Flyvbjerg (2009), in a comprehensive study of transport infrastructure projects across 20 nations, rail projects experienced an average cost overrun of 45%, and demand forecasts were overstated by more than 50%. These inaccuracies are not random but are systematically biased – often explained by planning fallacy and strategic misrepresentation, concepts rooted in behavioral economics.

In public healthcare projects, similar distortions occur. A study published by Hilaris Publisher highlighted how emotional appeals, political pressures, and short-term vision often override rational financial evaluations. Decision-makers, under cognitive load and institutional inertia, may fall into confirmation bias – accepting optimistic projections while ignoring historical data suggesting otherwise. In public housing developments and disaster recovery programs, status quo bias and loss aversion often result in sticking with outdated strategies that are cost-inefficient, simply to avoid perceived political or reputational losses.

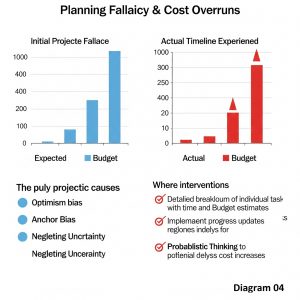

- Project Management and the Planning Fallacy

The planning fallacy, coined by Kahneman and Tversky, describes the human tendency to underestimate the time, costs, and risks of future actions while overestimating the benefits. This fallacy is prevalent in both private sector project management and large, scale public planning. According to empirical evidence cited on Wikipedia and corroborated by Arxiv.org preprints, even experienced professionals regularly fall into this trap. In IT projects, for instance, cost overruns of 27% on average and schedule delays of 70% have been reported (Standish Group, 2015). The root causes are often not technical, but psychological: overconfidence, groupthink, and optimism bias among project teams and leaders.

One notable case was the Denver International Airport’s automated baggage system, which ran hundreds of millions of dollars over budget due to unrealistic projections and resistance to changing flawed initial plans. Here, the sunk cost fallacy and anchoring on early schedules led to continued funding despite evident failures.

These empirical findings emphasize that understanding behavioral economics is not merely academic, it is vital to improving the precision and accountability of financial planning and cost management in real-world contexts.

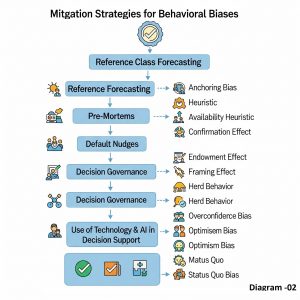

Mitigation Strategies

The growing recognition of how behavioral biases affect corporate cost management decisions has prompted the development of practical mitigation strategies. These range from psychological interventions (debiasing techniques) to the integration of technology and data-driven tools.

- Debiasing Techniques

One of the most effective behavioral interventions is reference-class forecasting – a method that compares a proposed project to similar past ventures to ground estimates in empirical reality rather than subjective projections. Kahneman and Lovallo (1993) suggested that using external data from a “reference class” can significantly reduce the planning fallacy and optimism bias. This approach is particularly useful in capital investments and budgeting forecasts.

Pre-mortem analysis, a concept championed by Gary Klein, requires teams to imagine that a project has failed and work backward to determine what could have led to the failure. This method encourages open dialogue, reduces groupthink, and identifies hidden risks early in the decision process.

Default nudges are subtle design choices that steer behavior without restricting freedom. For instance, setting cost-efficient procurement options as defaults can lead to significant savings. In procurement systems, defaulting to pre-approved vendors with negotiated pricing structures reduces impulsive or unvetted spending decisions.

Another critical mitigation is decision governance, which structures decision-making hierarchies, enforces checks and balances, and separates forecasting responsibilities from strategic advocacy. This can reduce motivated reasoning and allow for more objective cost assessments.

- Technology Tools and Data Analytics

Advances in artificial intelligence (AI), big data, and predictive analytics have provided new ways to counter human bias. Data-driven dashboards now allow for real-time cost tracking, variance detection, and pattern recognition, enabling faster and more accurate corrective action. Automating routine financial functions through IT delegation (e.g., algorithm-based procurement or forecasting models) can help minimize cognitive errors introduced by fatigue or stress.

Tools like ERP systems, cost-modeling software, and risk-assessment algorithms increasingly serve as objective counterweights to subjective managerial judgment – especially when integrated with behavioral insight-informed parameters.

Conclusion

In conclusion, the integration of behavioral economics into corporate cost management is not merely an academic exercise, it is an urgent necessity for organizations aiming to improve decision quality and financial outcomes. Cognitive biases such as optimism bias, anchoring, and the sunk cost fallacy often undermine accurate budgeting, procurement efficiency, and investment rationality. By recognizing and addressing these behavioral distortions, firms can avoid costly errors and better align their financial strategies with reality.

Incorporating behavioral insights into cost management practices, through debiasing techniques, data analytics, and improved decision governance- empowers managers to make more informed and rational choices. As organizations face increasingly complex economic environments, those that proactively adapt and apply behavioral principles will likely gain a significant competitive advantage. Thus, embedding behavioral economics into cost management frameworks should be a strategic priority for forward-thinking leaders and financial professionals.

Reference List

- Ariely, D. (2009). Predictably irrational: The hidden forces that shape our decisions. HarperCollins.

- Bazerman, M. H., & Moore, D. A. (2012). Judgment in managerial decision making (8th ed.). Wiley.

- Flyvbjerg, B. (2009). Survival of the unfittest: Why the worst infrastructure gets built—and what we can do about it. Oxford Review of Economic Policy, 25(3), 344–367. https://doi.org/10.1093/oxrep/grp024

- Kahneman, D. (2011). Thinking, fast and slow. Farrar, Straus and Giroux.

- Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291. https://doi.org/10.2307/1914185

- Kahneman, D., & Lovallo, D. (1993). Timid choices and bold forecasts: A cognitive perspective on risk taking. Management Science, 39(1), 17–31. https://doi.org/10.1287/mnsc.39.1.17

- Klein, G. (2007). Performing a project premortem. Harvard Business Review, 85(9), 18–19.

- Loewenstein, G., & Lerner, J. S. (2003). The role of affect in decision making. In R. J. Davidson, K. R. Scherer, & H. H. Goldsmith (Eds.), Handbook of affective sciences (pp. 619–642). Oxford University Press.

- Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving decisions about health, wealth, and happiness. Yale University Press.

- Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science, 185(4157), 1124–1131. https://doi.org/10.1126/science.185.4157.1124